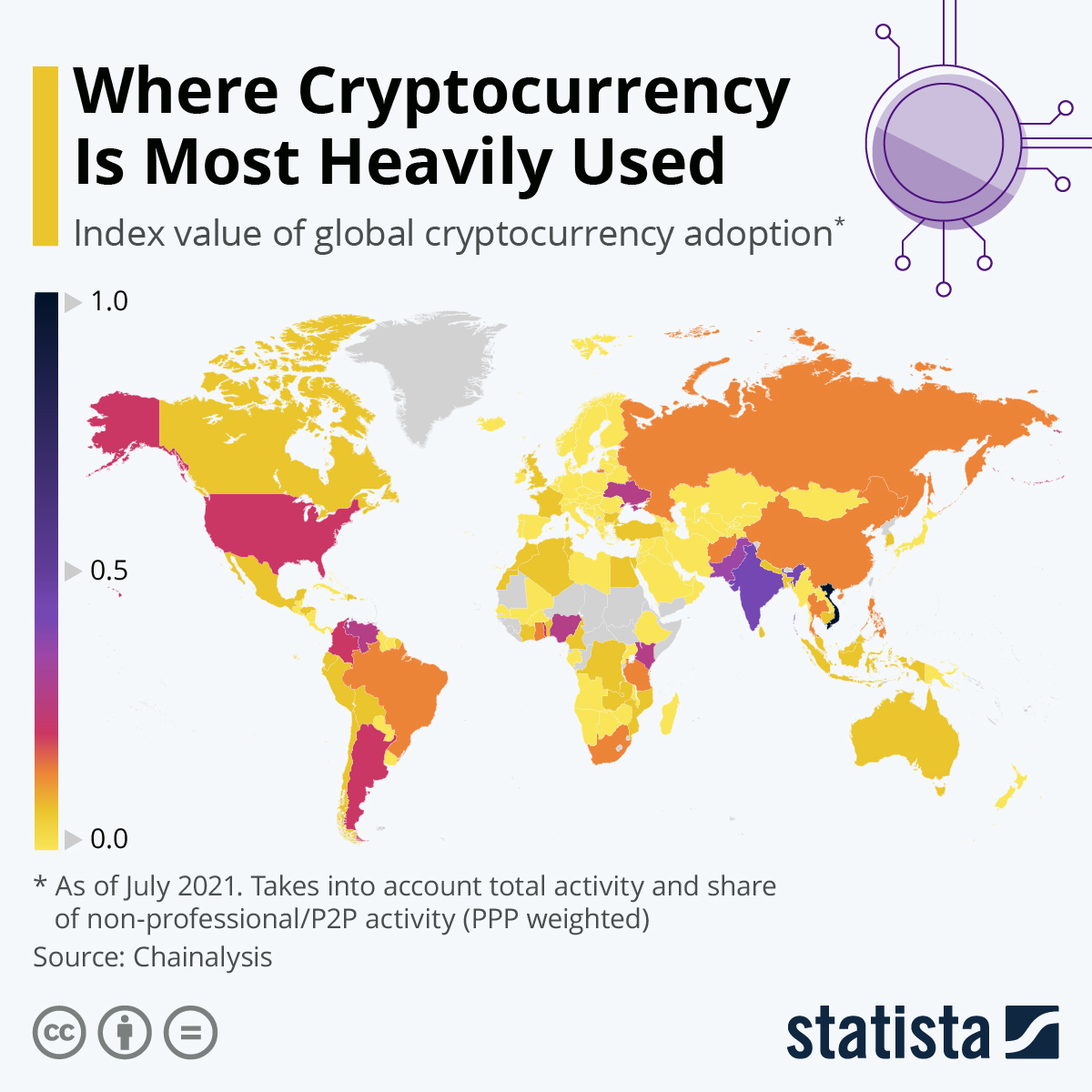

In an SHTF situation, I wonder if cryptocurrency will be an option. I'm not totally opposed to it, but prefer PM's, mainly silver, and barter. I should probably get a little crypto just for diversification.

It's already the case that some useful items are much more readily available if one has crypto to exchange for them. This is certainly the case with beneficial psychoactive herbal medicines, but it's ramping up with firearms and will only increasingly become the case with them and ammunition.

Don't just buy

any crypto, though. Most will be appropriated and taxed -- and perhaps even confiscated -- by the central-bank/central-governments consortiums if they get just a little bit further along the roads they're traversing. Buy Bitcoin (BTC and BCH) or maybe Ethereum. Most of the rest seriously risk becoming effectively worthless.

The main risk to Bitcoin is a system-wide failure of the internet, but the ruling class, according to Catherine Austin Fitts and others, has already seriously considered bringing down the internet and ultimately rejected the notion. If it goes down for good, an entirely different system would have to be set up to recreate the ability to trade it, but if it does go down, it will be worthless until such a system is deployed. Which could be never. However, what the ruling class learned was that it's entirely unfeasible for them to shut down the internet, because now far too much of what

they depend on it dependent itself on the digital world. They won't mind if the world left over for the rest of us sucks big-time, but they don't want to personally have to return to the Stone Age.

These are times in which it's essential to do at least a moderate level of prepping, but some of that prepping isn't just gathering essentials, buying land and learning how to live on a subsistence basis -- it's also imperative to think enough outside of the box to prepare to

be the kind of person who can not only navigate a significantly-altered world but who can become someone in a category that the ruling class doesn't consider entirely expendable. One avenue for this is to become an undamaged (and thus avoidant of the Poison Death Shot) survivor who is otherwise compliant, obedient and content with being a dependent underling. But the ruling class depends on a whole range of competencies in which they themselves don't want to have to engage. Plumbers, electricians, construction workers, firemen, policemen, etc. come to mind. But it won't be limited to just that if they get their way. Certain other types of constitutional toughness will be highly valued by our betters after they've managed to decrease the population by, say, 90%.

Being a survivor is a complex endeavor during complex times.